Do I need to specify this has been a golden year for domestic crypto and blockchain startups as the investors are lining up to cash in on the India's large customer base? So, let us jump the gun and talk about advertisement in this crypto space.

The market

The total funding for these crypto startups stand at $587.16 million this year as compared to $37 million in the previous year. A stellar exponential rise, with bulk of these capital flowing in from international investors.

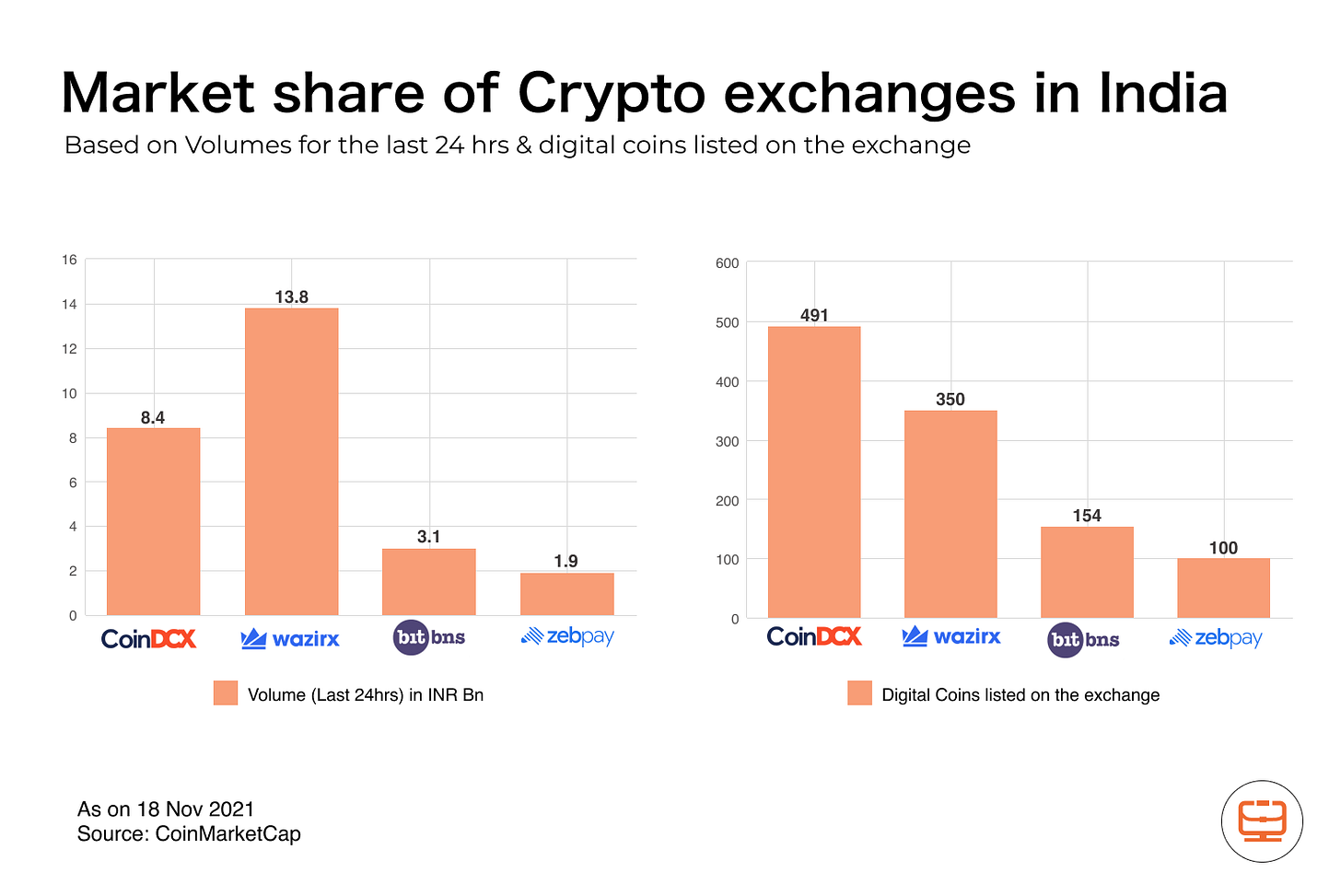

We saw two crypto exchanges making it to the unicorn list - CoinDCX and Coinswitch Kuber - with cashing in for 60% of India's market. Binance-owned Indian cryptocurrency exchange WazirX claims that its user base has increased ten-folds.

The question is who is winning the race? I think all of them. I highly doubt if it is the fight of one over the other but rather all against the Indian ecosystem. Clearly, the exchanges are on the winning side as they start to penetrate in Tier 2 & 3 cities with more and more people getting excited about Doge coin over Tata Power stocks.

Growth and Advertisement

So 'yahi future hai?' or 'Sab simple hai!'? Is this the reasoning why there are more Shiba coin owners than ITC shareholders crying over Twitter? It is not that simple, to be honest.

The humungous funding that these exchanges raise, also brings forth aggressive growth strategies and hence such ad campaigns. These high decibel campaigns are all over the place, TV, online streaming platforms, newspapers, and even billboards. The sector is expected to have an ad-spend ranging between Rs 150-180 crore, in the on-going financial year, as per Financial Express.

Let us talk some more numbers!

Over 30 crypto platforms have advertised on digital between January-July 2021. Of these only two players — WazirX and CoinDCX have spent money on TV. CoinSwitch Kuber is the top brand on digital with a 49% share of ad insertions, followed by CoinDCX with a 22% share. Meanwhile, WazirX and ZebPay accounted for a 10% share of ad insertions each. ~ Financial Express

IPL 2020 & ICC World Cup

India's most loved sport has become an open ground for startups to pitch their value proposition. Indeed a very smart way to attract the younger audience who would be willing for the experimentation and might give in to FOMO pretty quick. Hence, these exchanges are going big on ads featured in IPL as well as the ICC World Cup.

During the ICC T20 World Cup tournament, CoinDCX spend a total of Rs 40 crore on ads on Star Sports, sponsoring 50 advertisements per match across all channels, the Economic Times reported. CoinSwitch Kuber spent more than Rs 10 crore on sponsorship on Disney+Hotstar, while WazirX and other exchanges spent Rs 4-6 crore on ads during the championship.

Grey Areas

While we are discussing this elephant in the room, let us also shed light to all other grey areas which tend to misinform the public.

A report by Times of India reveals that at over 10 crore, India has highest crypto owners followed by USA and Russia. This makes around 7.3% of the Indians. Crazy right? Will you almost not give in to this piece of information?

Well, as pointed out by Coin Crunch, it is a bogus claim. Majority of the reports which state such absolute numbers are not legitimate and derive these figures from sourced from somewhere else.

Statistica and Hootsuite Report Findings stated 8.8% and 8% in the age group of 18-64 and 16-64 hold cryptos in India. The number was based on a smaller sample size based on the 'percentage of respondents', hence the generalised percentage of entire nation is way too stretched. Only the exchanges have precise numbers.

Also, not ruling out the possibility of the same person opening multiple accounts on all exchanges just for penny referrals and bonus, not understanding the risk of KYC getting exposed at multiple places.

Regulatory Stance

Recently the Government has displayed a strong stance against the misleading advertisements done by various crypto exchanges and termed them as “over-promising” and “non-transparent”. This rigid step was fuelled by the petition filed by Advocate Aayush Shukla and Advocate Vikas Kumar on 7th July in the Delhi High Court seeking the same monitoring of crypto-currency advertisements as mutual funds. Soon after receiving the petition, the Court ordered SEBI and the respective ministries, as well as Crypto-exchanges, to include 'standardised' disclaimers in their television advertisements.

Now, let’s dive deep in the matter, to know the actual claims that were made by the petitioners-

Crypto assets are riskier than traditional equity investment products such as stock market shares, mutual funds, and all other types of financial instruments that offer investment options.

Crypto-assets must be treated in the same way as mutual funds are.

Retail investors who are unaware of the underlying features of crypto-assets and their risk profile must be protected.

In light of these allegations, the petitioner asked SEBI to create rules requiring disclaimer text to occupy at least 80% of the screen. It also required that a voiceover be read slowly rather than quickly, as is customary. The petition requested that the reading last five seconds for all the audio-visual marketing sponsored by crypto-asset exchanges.

In addition to the Court's request to include standardised disclaimers, the Court has sought responses from SEBI, respective ministries, and Crypto-exchanges in order to reach a consensus for a well monitored advertising scheme. The case is now set to be heard on December 3, 2021.

Even Prime Minister Narendra Modi after chairing a meeting on the way forward for managing the cryptocurrency sector on 13th November, 2021, cautioned younger generations on on unregulated crypto markets and it becoming avenues for money laundering and terror financing. Concerns were raised over what was seen as “attempts to mislead the youth through over-promising” and “non-transparent advertising.”

Analysis of the crypto-ad fiasco

Crypto-ads are indeed misleading due to the tall claims and extravagant words they use such as – “apka paisa safe hai”, “India’s safest crypto exchange”, “maalamaal hojao” and other phrases on the same line. These exchanges need to determine how the money is safe or what are the instruments that can be used for investor protection. So, here people need to know two very important aspects of this whole crypto-currency investing fad-

First, unlike securities or shares, cryptocurrency is not stored in a centralised wallet. In other words, while securities can be stored in a demat account monitored by central authorities such as NSDL or CDSL, cryptocurrency is stored in a digital wallet monitored solely by the Crypto-exchange itself, raising the red bar significantly. We don't have to go very far in history to see that when the KARVY Scam occurred or other such scams, wherein many investors lost their money. This scam resulted in the country's securities framework becoming more stringent, and it appears that we are now waiting for another scam under the same pretext, in which a crypto-exchange can easily wash away investors' money.

Second, what are the actual legal instruments that investors can use to protect themselves against fraud or insider trading against crypto-exchanges or market liquidators? There is no regulatory framework in place for this type of crime, and the least investors can do is file a money-recovery suit or a fraud suit, which takes a long time to resolve.

Though the entire world is finding it difficult to regulate such a complex subject, the regulators and the judiciary should be active enough to decide on the matter on case to case basis. For eg. The Advertising Standards Authority of London is active enough to ban a misleading subway advertisement stating- "If you're seeing Bitcoin on the underground, it's time to buy" or an advertisement stating "there is no point in keeping your money in the bank" and further describing Bitcoin as “digital gold”. So, based on these precedents, cryptos can be regulated on a case-by-case basis until a regulatory framework is established.

So, “maalamaal hojaoge?”. Maybe or maybe not. Nevertheless, take an informed approach and invest in assets you understand.

Great Piece, Covered various Nuances

Must have information...