What are ESOPS?

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company; this interest takes the form of shares of stock. ~ Investopedia

In simple words, ESOPs are formed for the employees to facilitate buying stocks in a closely held company before it goes public. It can be with the motive of succession planning, employee retention, or rewarding.

But, what ESOPs are not?

ESOPs are not stocks but stock options. Hence, one doesn't own stocks as per the ESOP but rather has the choice or option to own in the future at a pre-decided price.

ESOPs are free of cost as a part of employee’s remuneration but actual exercising is not. When an employee exercises the right to buy the shares in the company, the employee will have to pay the “exercise price” (or the purchase price) for these shares.

ESOPs are not non-taxable. It comes under a source of income and is taxed accordingly.

ESOPs are not liquidated only at the time of IPO. There are other several circumstances (discussed further in the article) where they can be liquidates.

Terminologies

A grant letter is a formal document issued by a startup for granting ESOPs to an employee. There are certain terminologies that one might find on the grant letter that needs to be understood before signing on the dotted line.

Exercise Price: Exercise price is the price at which the holder of stock options has the right, but not the obligation, to purchase the stock options within a term period. This is also called as the strike price. It is usually lower than the stock’s Fair Market Value (FMV). It is by default the Face Value(FV) of per share but increases over time. Hence, Face Value < Exercise Price < FMV.

Cliff: A cliff represents the minimum period of time that must elapse in the organisation before you claim ownership of the stock options. Usually it is one year.

Vesting: It is the process in which an employee gets the right to own the stock options on a systematic basis or a pre-set calendar. This depends from company to company. Some might follow quarterly or half-yearly vesting or some might offer performance-based vesting.

Exercise Period: Exercising is the process in which one converts the stock options into actual stocks to officially become a shareholder in the company by paying the exercise price. This always specifies the time period in which you have the right to claim the options after you leave the organisation.

Timeline of an ESOP

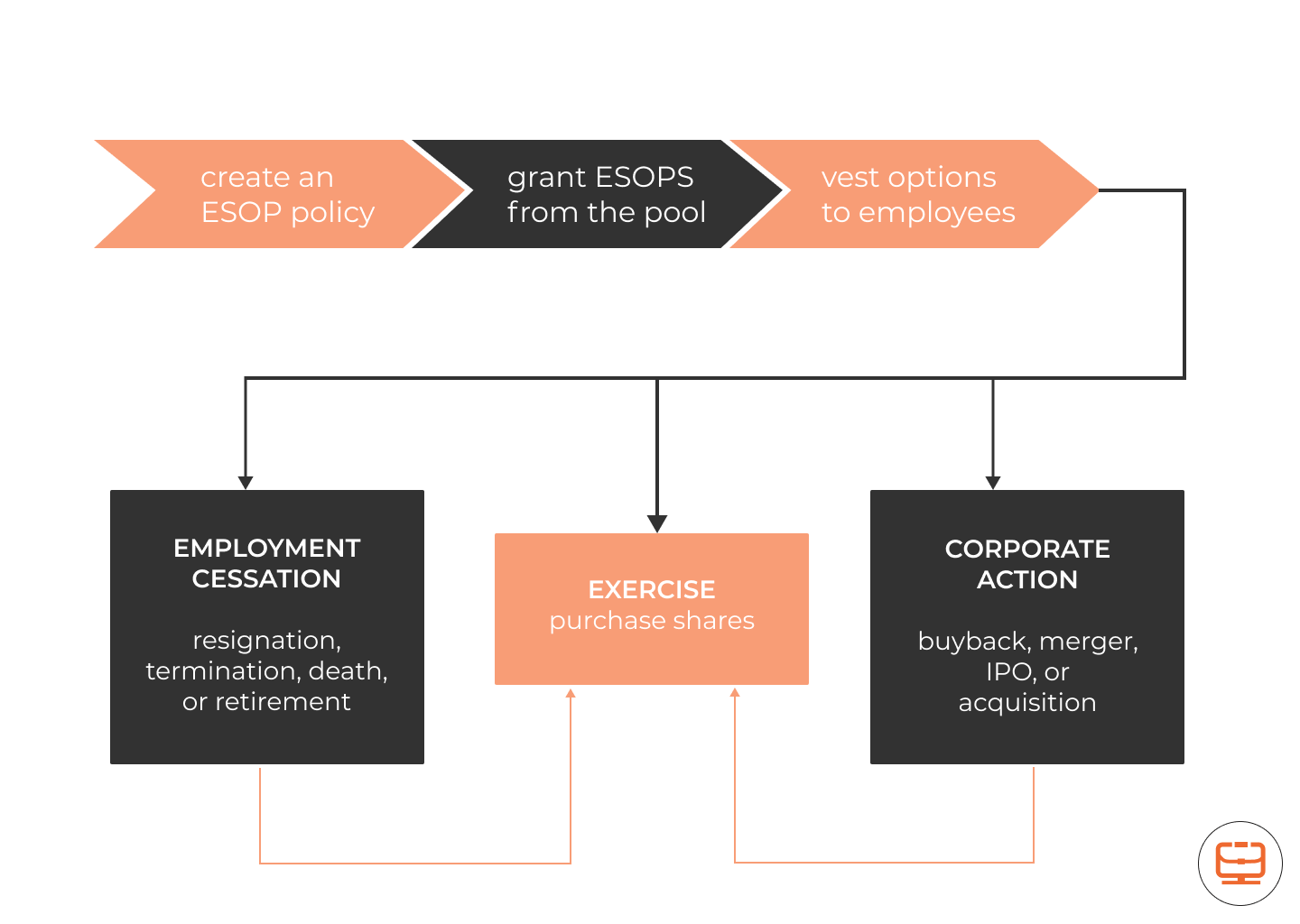

A startup creates a ESOP pool to grant stock options to its employees. Each grant letter specifies the details of the options being issues including clauses and terminologies as described above. These options are then vested based on the clauses mentioned.

But what about exercising?

Once vested, stock options can be exercised any time by the employee. However, employees prefer to exercise it when there is a scope of liquidity. This can be in a form of corporate action like buybacks, mergers, IPOs or even acquisition.

Also, at the time of employment cessation, these stock options are exercised or to be sold. Companies specify an exercise period after termination of employment within which these options need to be exercised. Many employee tend to let go of ESOPs only because the exercise period after the employment cessation is too short.

Calculations for ESOPs

Before investing in any startup, investors and founders arrive at a value. This value is usually a multiple of revenue on the date of valuation.

Annual revenue: Rs. 5 LakhsValuation multiple: 5x of revenueTotal Valuation: Rs. 25 LakhsNo. of existing shares: 25,000Value / share = Rs. 100As per the grant letter, the strike or exercise price for you is Rs. 100. In a hypothetical scenario, fast forward to a year later, say the value the same shares have increased. Time for our favourite part, calculation of P&L. Well, hopefully only ‘P’ in this case.

Let us say,

Exercise Price (the price at which the employee purchased the options): Rs. 100Fair Market Value (current price): Rs. 130No. of shares allotted: 5000Gain = (Fair Market Value- Exercise price)* No. of shares = Rs. 1,50,000Congratulations! You've made a huge profit. Who would have thought minting money would be so much easy? Well, it is not all shine and sparkles as there is a catch.

INCOME TAX! Since this is essentially a source of income, you're liable to pay taxes for the same.

Taxation of ESOPS

ESOPs are taxed at two occasions:

At the time of allotment (as a perquisite)

The difference between the fair market value on the exercise date and the price paid by the employee at the time of subscription or at the time of exercise calculated during allotment, is taxed as perquisite. The difference calculated as perquisite is the tax deductible at source and is shown in the employee’s form 16.

Consider the previous example where the gain was Rs. 1,50,000. Assuming, the employee falls in the highest tax bracket, the deductible tax would be 30% and an additional cess of 4%. So the deductible tax would be: 30% of Rs. 1,50,000 (and 4% cess on it) i.e. Rs. 45000 + Rs 1800 (4% of 45000)= Rs.46,800.

So, the employee would be liable to pay Rs. 46,800 as tax during the allotment of ESOPs.

At the time of sale (as capital gain)

In the second case, when an employee chooses to sell his or her share, the profit is considered a capital gain. Capital gain is taxed, and it is calculated as the difference between the share's fair market value on the exercise date and its sale value.

Capital gain can be of two types:

Short Term Capital Gain - When the options are sold within 12 months of purchase, the tax is deducted at the rate of 15%.

Long Term Capital Gain - When the options are sold after 12 months of purchase, the tax is deducted at the rate of 10% on the amount over Rs. 1 lakh.

Let us understand with an example.

Capital Gain = (130-100)*5000 = Rs. 1,50,000Assuming it as a short-term gain:

Deductible Tax = 15% of Capital Gain= (15*1,50,000)/100= Rs. 22,500Assuming it as a long term gain:

Deductible Tax = 10% of (Capital Gain- Rs. 1 lakh)= (10*(1,50,000- 1,00,000))/100= Rs. 5000Budget 2020 Amendments

Startups (who rely heavily on ESOPs to retain people) encountered practical issues in taxing ESOPs as perquisites. As previously stated, in order to meet the TDS duty, an employee must either sell a portion of his shares or raise funds from other means. Finding buyers for startup shares can be difficult because they are typically not listed and there may not be an active market. Following a review of different representations and an appreciation of the true hardships experienced by startups, the Income Tax Act was changed to grant assistance to 'eligible startups.'

In layman's terms, an 'eligible startup' is a company or an LLP formed after April 1, 2016 but before April 1, 2022. Furthermore, it must meet the turnover requirement (not more than 100 crores) and carry on eligible business as defined.

The Advantage

TDS can be deducted by an eligible startup within 14 days:

After 48 months have passed since the end of the relevant assessment year, or

From the date of sale of such shares,

From the date of the employee's resignation.

So, if you are allotted shares in fiscal year 2020-21, the earliest date on which your employer (as an eligible startup) is required to deduct TDS is April 14, 2026. (assuming you continue to hold the shares and are in employment with the company till that date).

It's a positive decision because an employee now has at least 5 years to pay tax on the perquisite income unless he resigns or sells the shares before then. It gives the employee the option of keeping the shares and not having to sell a portion of them to meet tax obligations. What is unfair is that the relief is only available to employees of eligible startups. The proportion of eligible start-ups in comparison to the total number of companies issuing ESOPs is insignificant. Perhaps the government's intention is to assist startups rather than the salaried class in general.

Summing up

ESOPs are indeed powerful since they can generate an exponential wealth for an employee. However, it is important to understand all that is being provided to you as per the grant letter for better understanding and negotiation. ESOPs have gained even more importance after startups likes of Zomato & Paytm went public and generated enormous wealth for its shareholders.

That is not it, something really interesting is brewing in this domain.

Unacademy offers "TSOPs" for their teachers.

Licious says "Everyday vesting, Anytime Liquidation".

Meesho has "MeeSOP” where one can convert CTC into ESOPs.

The ecosystem has started to move beyond just the base salary compensation and yet again the future seems bright.